Audience-Driven, SEO-Informed Content Strategy

Case Study:

Capturing Market Visibility for a New Healthcare Division

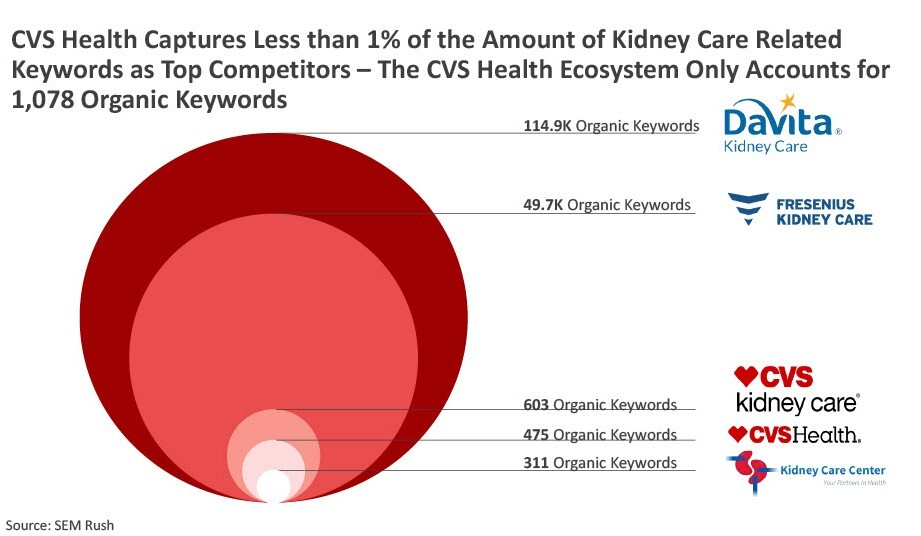

CVS Kidney Care was a medical device division buried within a healthcare giant. Despite the backing of CVS, the website cvskidneycare.com was basically invisible in search. Established players ranked for more than 114,000 different keywords, keyphrases, and longtails. Rather than building on CVSHealth.com's established domain authority, the division had launched with its own website, CVSkidneycare.com. It was capturing just 603 organic keywords. We needed an SEO-driven content strategy that could build awareness and market presence.

The Issue

Every month, tens of thousands searched for answers on kidney health—but none found CVS Kidney Care.

We were the new kids on the block, trying to break into a space our competitors dominated. Across the full CVS Health web presence, we only ranked for 1,078 kidney care-related organic keywords. DaVita ranked for 106 times as many and was receiving almost 40 times as much organic traffic.

There were more than 74,000 monthly searches for "kidney failure symptoms," just over 12,000 searches each month for “kidney function test” and almost 10,000 monthly searches for "foods for kidney health." In all cases, CVS Kidney Care was not visible.

But this was more than just a numbers problem. Each one of those search queries represented a potential patient or caregiver who might benefit from our specific care approach but would never discover it. We weren’t there in the moment they were looking for help.

The standard SEO play for a situation like this would be to create more content, build more links, and optimize harder—so, so hard—for all the same keywords everyone else was targeting. But when your two biggest competitors have 152 times as many keywords on lockdown, that approach is a total dead end. It’s like trying to win a shouting match against opponents with bullhorns by just talking louder.

So, instead of that, we began work on better understanding how people searched in this space, and what motivated their searches. What looked like a uniformly saturated market and an impossible uphill climb at first turned out to have some distinct layers with different dynamics we could use to our advantage.

Medical publishers like Mayo Clinic and WebMD had captured the high-volume informational searches, while established care providers like DaVita and Fresenius dominated the more service-related queries. But there were also gaps. And it was in these gaps where users had needs that weren't being fully addressed.

Audience Insights & Opportunities

Our research revealed three distinct audiences with very different search behaviors and goals:

- Caregivers (ages 25-44): Primarily younger women researching on behalf of older family members, asking information-heavy questions like "what is kidney dialysis" and "treatment for kidney disease." They drove the most question-focused searches but were being served by medical publishers rather than care providers, creating a gap between research and connection to actual care.

- Prevention Seekers (ages 45-65+): Health-conscious individuals focused on maintaining kidney health through lifestyle choices, generating the highest search volumes with terms like "kidney failure symptoms" and "foods for kidney health." They consumed informational content without connecting to provider services.

- Kidney Care Patients (ages 65+): People already diagnosed and evaluating treatment options, searching for service-specific terms like "home dialysis" and "dialysis machine." They had the highest service-seeking intent but went directly to established providers who dominated rankings.

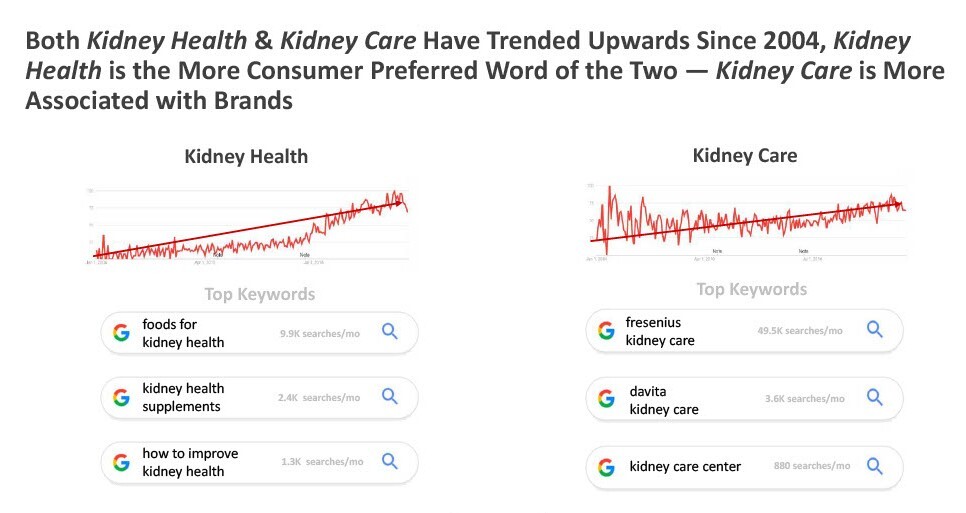

The market was split between two fundamentally different search intents. The "kidney health" searches represented the preferred language when people were researching prevention and general information (6.6K monthly searches).

On the flip side, "kidney care" queries were more symptom-, diagnosis-, and treatment-focused, and though they had a lower search volume (1.6K monthly searches), they indicated the active service-seeking intent and the evaluation of providers and treatment options.

How We Could Compete

Medical publishers like WebMD and Mayo Clinic controlled the higher-volume "kidney health" space, while established providers like DaVita and Fresenius owned "kidney care" service queries. As a small startup-style division, we had neither the content authority of Mayo Clinic nor the market recognition of DaVita.

But our research revealed an opportunity. While our site did not yet have search authority, the main CVS Health site did. It attracted users seeking general kidney health information—and these visitors represented potential people seeking care for themselves or a loved one.

Strategic links from that high-authority domain could pass significant SEO value to boost CVSkidneycare.com's search rankings. The challenge was to build a content strategy that could capture high-intent service queries while leveraging that SEO juice to help our new site compete for the treatment-seeking keywords that actually mattered.

The Strategy

With the landscape mapped, I was able to build an SEO-informed content strategy that focused on what we know about the audiences and their search behaviors. This kept us from having to try to out-compete established players on sheer keyword volume:

- Audience-first targeting: Prioritize caregivers, prevention seekers, and kidney care patients with content tailored to their intent.

- Treatment-focused positioning: Compete where patients actively evaluated care options (e.g., “home dialysis,” “kidney care at home”) rather than broad informational searches dominated by Mayo Clinic and WebMD.

- Content conquesting: Instead of chasing broad informational searches dominated by Mayo Clinic or WebMD, identify high-intent, mid-volume queries where we could leverage paid search to outmaneuver incumbents with relevance and authority.

Authority leveraging: Build domain authority by using CVS Health’s established presence in search to support and funnel traffic to CVS Kidney Care service pages.

The Execution

The content strategy I put together was meant maximize impact for our resource-constrained, small-but-mighty division:

- Audience research and content mapping: Analysis of the three primary audience segments and their distinct search behaviors helped define the journey recommendations for each.

- Caregivers: Search "what is kidney dialysis" → FAQ content on CVS Health → treatment options overview → "Learn more about home dialysis options" → CVS Kidney Care service pages

- Prevention seekers: Search "foods for kidney health" → nutrition guidance on CVS Health → kidney health maintenance content → "Kidney health monitoring services" → early intervention offerings

- Kidney patients: Search "home dialysis" → direct CVS Kidney Care service pages → treatment comparisons → "Compare home dialysis options" → provider consultation

- Strategic cross-domain linking: The linking strategy from CVS Health's higher-ranking informational content to our service pages created both referral traffic flow and SEO value to help establish CVSkidneycare.com's search authority.

- Competitor content gap analysis: Audited competitor content to determine where it was thin, then created material to answer evaluation-stage questions with more specificity, authority, and empathetic patient relevance.

- Content conquesting: Identified mid-volume, high-intent queries from the gap analysis where incumbent’s content left them vulnerable and ran a targeted paid-search ads to accelerate visibility and capture evaluation-stage traffic.

Performance measurement framework: Established KPIs focused on service-related keyword rankings, qualified patient inquiries from organic search, and successful referral traffic conversion from CVS Health's informational content.

The Results

The strategy positioned CVS Kidney Care as an authoritative option visible in search for a market where we'd been completely absent. Even though CVS later shifted its corporate strategy, the work delivered a clear framework for how to win search visibility in a crowded healthcare market:

- Leveraged audience clarity: Identified and segmented three distinct audiences—caregivers, prevention seekers, and kidney care patients—each with unique search behaviors, content needs, and care pathways that informed every strategic decision.

- Documented keyword landscape: Applied insights from the search term divide between "kidney health" and "kidney care" to guide where CVS could realistically compete rather than waste resources fighting entrenched medical publishers.

- Built strategic SEO pathways: Established cross-domain linking strategy to create a deliberate authority transfer in search rankings, accelerating CVS Kidney Care’s visibility on treatment-seeking queries.

- Delivered scalable framework: Created a resource-efficient approach for entering search spaces dominated by incumbents, balancing informational thought leadership with high-intent, service-focused queries where we could actually win visibility.

We took a virtually unknown service and created systematic visibility in search categories where people actively seek information to inform decisions about health, treatment, and support. This kind of strategic SEO work helps organizations reach their audiences and serve them better.